Blog

Sterling Gains Slightly as UK Inflation Accelerates; Euro Struggles Despite Wage Surge – ThynkFX

Sterling posted modest gains today after the UK reported stronger-than-expected rebound in headline inflation for October. More importantly, both core CPI and services price growth also increased, indicating that underlying inflation is gaining momentum.

This resurgence in inflation diminishes the likelihood of BoE implementing another rate cut in December. Market expectations have adjusted accordingly, with swaps markets now assigning only a 15% probability to a rate reduction next month. This shift aligns with BoE’s recent emphasis on a measured and gradual approach to policy easing. The central bank has stressed the need for additional time to assess the impact of the Autumn Budget before making further monetary adjustments.

In contrast, Euro failed to gain traction despite robust wage growth data from the Eurozone. ECB reported that negotiated wages in the third quarter rose by 5.42% yoy, a significant jump from the 3.54% growth in the second quarter. This also marks the fastest wage growth since early 1993. However, Euro remained subdued as concerns over sluggish economic activity overshadowed the inflationary pressures from rising wages.

The ongoing weakness in the Eurozone’s economic performance is expected to keep ECB on track for another 25b rate cut in December. While the central bank may proceed with this cut, the pace of easing next year is anticipated to slower as policymakers balance the need to support growth with the risks of fueling inflation.

Overall for the day, however, Dollar is the strongest one, followed by Sterling, and then Canadian. Yen is the worst, followed by Kiwi and then Aussie. Euro and Swiss Franc are mixed in the middle.

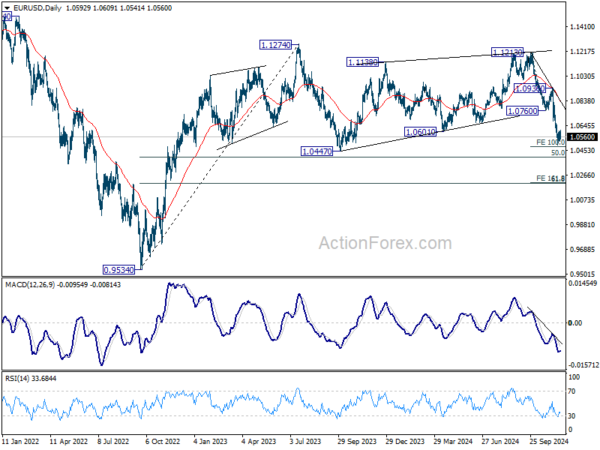

Technically, EUR/USD’s recent decline from 1.1213 might be ready to resume through 1.0495 temporary low soon. But the main question is whether it could draw enough support from 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404 to bring near term bullish reversal. Decisive break of 1.0404, however, will raise the chance of reversal and target 61.8% retracement at 1.0199.

In Europe, at the time of writing, FTSE is up 0.17% DAX is up 0.44%. CAC is up 0.41%. UK 10-year yield is up 0.040 at 4.480. Germany 10-year yield is up 0.036 at 2.380. Earlier in Asia, Nikkei fell -0.16%. Hong Kong HSI rose 0.21%. China Shanghai SSE rose 0.66%. Singapore Strait Times fell -0.38%. Japan 10-year JGB yield rose 0.0044 to 1.069.

UK CPI jumps to 2.3% in Oct, core CPI rises to 3.3%

UK CPI reaccelerated from 1.7% yoy to 2.3% yoy, above expectation of 2.2% yoy. Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.3% yoy, ticked up from prior month’s 3.2% yoy and above expectation of 3.1% yoy.

CPI goods annual rate rose from -1.4% yoy to -0.3% yoy, while the CPI services annual rate rose from 4.9% yoy to 5.0% yoy.

On a monthly basis, CPI rose by 0.6% mom, above expectation of 0.5% mom.

Japan’s exports rebound by 3.1% yoy in Oct, but trade deficit persists

Japan’s exports rose 3.1% yoy in October, reaching JPY 9,427B, a strong recovery from the -1.7% yoy decline in September, which marked a 43-month low.

This rebound was primarily driven by a 1.5% yoy increase in shipments to China, buoyed by strong demand for chipmaking equipment. However, exports to the US, Japan’s largest trading partner, fell -6.2% yoy, reflecting weakness in auto shipments.

On the import side, growth remained modest at 0.4% yoy, totaling JPY 9,888B. This resulted in a trade deficit of JPY -461B for the month, the fourth straight month of shortfall.

Seasonally adjusted data showed exports declining -0.7% mom to JPY 8,882B, while imports ticked up 0.2% mom to JPY 9,239B, leading to a seasonally adjusted trade deficit of JPY -358B.

Australia Westpac leading index hits 0.26%, decisive breakaway from year-long sluggishness

Australia’s Westpac Leading Index moved decisively into positive territory in October, rising from -0.20% in September to +0.26%.

This marks a significant shift, as the index had been hovering in slight negative territory, between -0.3% and flat, for most of the past year. The October reading is not only the first clear above-trend result since November 2023 (+0.16%) but also the strongest since July 2022 (+0.63%).

The improvement in the index provides a “constructive signal” for the economy’s future momentum. Westpac’s outlook aligns with this shift, forecasting an acceleration in economic growth from a nadir of 1.0% in mid-2024 to 1.5% by year-end and 2.4% by the end of 2025.

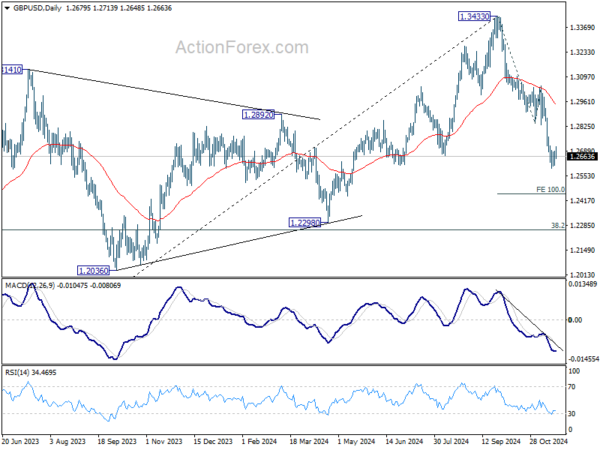

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2634; (P) 1.2662; (R1) 1.2711; More…

GBP/USD’s recovery extended higher today but lost momentum well ahead of 55 4H EMA. Intraday bias remains neutral at this point. Outlook stays bearish with 1.2842 support turned resistance intact. On the downside, break of 1.2596 will resume the fall from 1.3433 to 100% projection of 1.3433 to 1.2842 to 1.3047 at 1.2456.

In the bigger picture, a medium term top should be in place at 1.3433, and price actions from there are correcting whole up trend from 1.0351 (2022 low). Deeper decline is now expected as long as 55 D EMA (now at 1.2977) holds, to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. Strong support should be seen there to bring rebound.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Oct | -0.36T | -0.15T | -0.19T | -0.27T |

| 01:00 | CNY | PBoC 1-Y Loan Prime Rate | 3.10% | 3.10% | 3.10% | |

| 01:00 | CNY | PBoC 5-Y Loan Prime Rate | 3.60% | 3.60% | 3.60% | |

| 07:00 | EUR | Germany PPI M/M Oct | 0.20% | 0.20% | -0.50% | |

| 07:00 | EUR | Germany PPI Y/Y Oct | -1.10% | -1.10% | -1.40% | |

| 07:00 | GBP | CPI M/M Oct | 0.60% | 0.50% | 0.00% | |

| 07:00 | GBP | CPI Y/Y Oct | 2.30% | 2.20% | 1.70% | |

| 07:00 | GBP | Core CPI Y/Y Oct | 3.30% | 3.10% | 3.20% | |

| 07:00 | GBP | RPI M/M Oct | 0.50% | 0.50% | -0.30% | |

| 07:00 | GBP | RPI Y/Y Oct | 3.40% | 3.40% | 2.70% | |

| 07:00 | GBP | PPI Input M/M Oct | 0.10% | 0.60% | -1.00% | -0.50% |

| 07:00 | GBP | PPI Input Y/Y Oct | -2.30% | -2.50% | -2.30% | -1.90% |

| 07:00 | GBP | PPI Output M/M Oct | 0.00% | -0.10% | -0.50% | -0.40% |

| 07:00 | GBP | PPI Output Y/Y Oct | -0.80% | -0.90% | -0.70% | |

| 07:00 | GBP | PPI Core Output M/M Oct | 0.30% | 0.00% | ||

| 07:00 | GBP | PPI Core Output Y/Y Oct | 1.70% | 1.40% | ||

| 15:30 | USD | Crude Oil Inventories | -0.1M | 2.1M |