Blog

Swiss Franc and Dollar Gain as Putin Warns of Global War Escalation, Euro Awaits PMIs – ThynkFX

Swiss Franc and US Dollar appreciated broadly today as investors sought safe-haven assets in response to escalating geopolitical risks. Gold extended its near-term rebound, while Bitcoin surged to a new record high, reflecting heightened demand for alternative stores of value.

The catalyst for this shift was a warning from Russian President Vladimir Putin that the conflict in Ukraine is escalating toward a global scale. Putin stated that Russia responded to Ukraine’s use of US and British-supplied missiles by launching a new hypersonic medium-range ballistic missile at a Ukrainian military facility. He indicated that additional actions could follow, intensifying concerns about a broader confrontation involving major powers.

Despite these developments, the risk-off sentiment was not uniformly reflected across global markets. DOW closed significantly higher overnight, while NASDAQ edged lower. In Asia, market performance was mixed; Japan’s Nikkei 225 advanced whereas Hong Kong’s HSI and China’s SSE trade in red.

Australian Dollar pulled back slightly but remains one of the week’s strongest performers, despite mixed PMI data. Meanwhile, Yen continued to trade within familiar ranges, showing limited reaction to both the geopolitical developments and stronger-than-expected Japanese CPI data.

Attention is now turning to the Eurozone’s PMI data scheduled for release today. This data will be particularly significant after Euro’s broad-based decline yesterday, breaking key support levels against several major currencies.

Technically, EUR/CHF’s near term decline resumed and breaks through 0.9305 support. Attention is now on whether it picks up downside momentum for breaking through 0.9209 low decisively.

In Asia, at the time of writing, Nikkei is up 0.76%. Hong Kong HSI is down -1.70%. China Shanghai SSE is down -1.58%. Singapore Strait Times is up 0.07%. Japan 10-year JGB yield is down -0.0101 at 1.086. Overnight, DOW rose 1.06%. S&P 500 rose 0.53%. NASDAQ rose 0.03%. 10-year yield rose 0.026 to 4.432.

Japan’s CPI eases to 2.3% in Oct, core-core rises to 2.3%

Japan’s inflation data for October revealed persistent and broadening price pressures. Core CPI (excluding food) eased slightly to 2.3% yoy, down from 2.4% yoy but exceeding expectations of 2.2% yoy. This marked the 31st consecutive month core CPI has stayed at or above BoJ’s 2% target.

Core-core CPI (excluding food and energy) rose from 2.1% yoy to 2.3% yoy, underscoring renewed strength in underlying inflation. Headline CPI moderated from 2.5% to 2.3%, partly due to slowing energy price gains, which decelerated sharply to 2.3% yoy from 6.0% yoy in September. However, food prices surged 3.8% yoy, accelerating from 3.1% yoy, while services prices edged up to 1.5% yoy from 1.3% yoy.

The combination of steady inflation momentum, recovering consumer spending, and Ten’s renewed weakening bolsters the argument for a BoJ rate hike at its upcoming policy meeting in December.

Japan’s PMI manufacturing falls to 49.0, services rises to 50.2

Japan’s PMI Manufacturing index edged down to 49.0 from 49.2 in November, signaling a deepened contraction in the sector. In contrast, PMI Services rose slightly to 50.2 from 49.7, indicating a renewed, albeit modest, expansion. PMI Composite improved marginally but remained below the neutral mark at 49.8, up from 49.6.

Usama Bhatti, Economist at S&P Global Market Intelligence, noted that demand conditions were “stagnant,” while employment grew at the fastest rate in four months. Price pressures persisted across sectors, driven by rising raw material costs and Yen’s weakness. Firms responded with sharper increases in prices charged for goods and services, aiming to pass on these higher cost burdens to customers.

Australia’s PMI composite falls to 49.4, second contraction in three months

Australia’s PMI Manufacturing improved sharply from 47.3 to 49.3 in November, marking a six-month high but remaining in contraction territory. Conversely, PMI Services index dropped from 51.0 to 49.6, hitting a 10-month low and signaling contraction. PMI Composite fell from 50.2 to 49.4, its lowest level in 10 months, indicating a slight overall contraction in private sector output for the second time in three months.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, highlighted the significance of the services sector’s slowdown. “The November S&P Global Flash Australia PMI posted the lowest reading since January, bringing the fourth-quarter average thus far below that of the prior quarter,” Pan said.

The report also noted that easing capacity pressures and subdued activity contributed to slower employment growth, which fell further below the long-term average. In addition, selling price inflation eased as businesses showed caution in raising charges. This combination of softer employment growth and reduced price pressures supports expectations of lower interest rates.

Looking ahead

UK will release retail sales and PMI flash in European session. Germany will release GDP final. Eurozone will also release PMI flash. Later in the day, Canada will release retail sales. US will also release PMI flash.

EUR/USD Daily Outlook

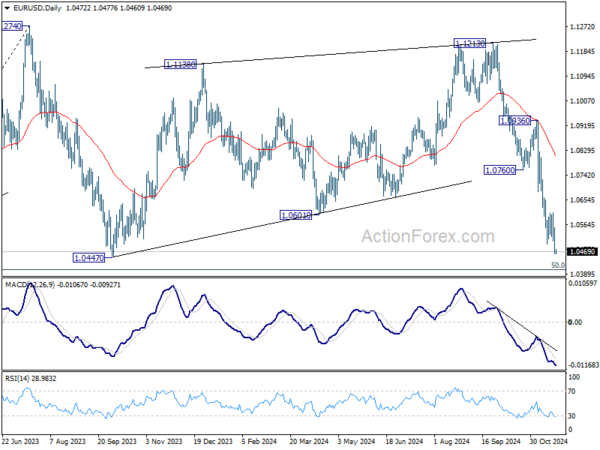

Daily Pivots: (S1) 1.0439; (P) 1.0497; (R1) 1.0532; More…

EUR/USD’s fall from 1.1213 resumed by breaking through 1.0495 temporary low. Intraday bias is back on the downside for 1.0447 support and then 1.0404 key fibonacci level next. Strong support could be seen from this zone to bring rebound. But risk will stay on the downside as long as 1.0609 resistance holds. Decisive break of 1.0404 will carry larger bearish implications.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage. However, firm break of 1.0404 will raise the chance of reversal and target 61.8% retracement at 1.0199.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Nov P | 49.4 | 47.3 | ||

| 22:00 | AUD | Services PMI Nov P | 49.6 | 51.0 | ||

| 23:30 | JPY | National CPI Y/Y Oct | 2.30% | 2.50% | ||

| 23:30 | JPY | National CPI Core Y/Y Oct | 2.30% | 2.20% | 2.40% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Oct | 2.30% | 2.10% | ||

| 00:30 | JPY | Manufacturing PMI Nov P | 49.0 | 49.5 | 49.2 | |

| 00:30 | JPY | Services PMI Nov P | 50.2 | 49.7 | ||

| 07:00 | EUR | Germany GDP Q/Q Q3 F | 0.20% | 0.20% | ||

| 07:00 | GBP | Retail Sales M/M Oct | -0.30% | 0.30% | ||

| 08:15 | EUR | France Manufacturing PMI Nov P | 44.6 | 44.5 | ||

| 08:15 | EUR | France Services PMI Nov P | 49 | 49.2 | ||

| 08:30 | EUR | Germany Manufacturing PMI Nov P | 43.1 | 43 | ||

| 08:30 | EUR | Germany Services PMI Nov P | 51.8 | 51.6 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Nov P | 46 | 46 | ||

| 09:00 | EUR | Eurozone Services PMI Nov P | 51.6 | 51.6 | ||

| 09:30 | GBP | Manufacturing PMI Nov P | 50.1 | 49.9 | ||

| 09:30 | GBP | Services PMI Nov P | 52.3 | 52 | ||

| 13:30 | CAD | Retail Sales M/M Sep | 0.30% | 0.40% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Sep | -0.50% | -0.70% | ||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.10% | 0.00% | ||

| 14:45 | USD | Manufacturing PMI Nov P | 48.5 | |||

| 14:45 | USD | Services PMI Nov P | 55 | |||

| 15:00 | USD | Michigan Consumer Sentiment Nov F | 73 | 73 |